The Single Strategy To Use For Medicaid

Wiki Article

7 Simple Techniques For Health Insurance

Table of ContentsUnknown Facts About Renters InsuranceCar Insurance for BeginnersAn Unbiased View of Home InsuranceMedicaid Can Be Fun For Everyone

You Might Want Disability Insurance Too "As opposed to what lots of people think, their home or cars and truck is not their best asset. Rather, it is their ability to earn an income. Yet, lots of specialists do not insure the chance of a special needs," said John Barnes, CFP as well as owner of My Domesticity Insurance Coverage, in an email to The Balance.

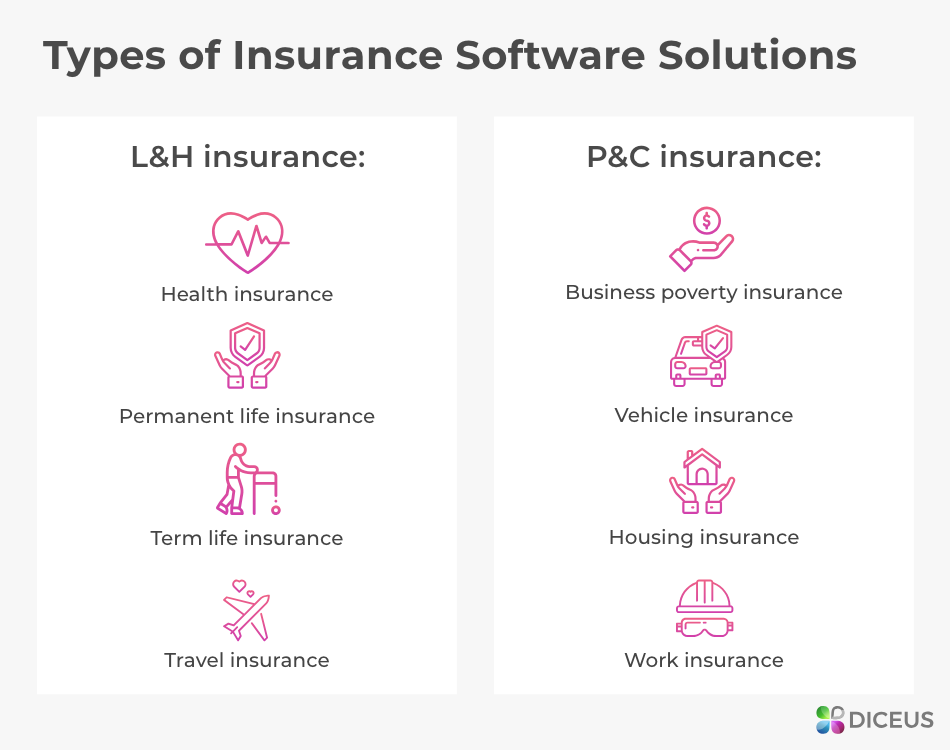

The information below focuses on life insurance marketed to individuals. Term Term Insurance is the easiest form of life insurance policy.

The expense per $1,000 of benefit rises as the guaranteed individual ages, and also it undoubtedly gets very high when the guaranteed lives to 80 as well as beyond. The insurance company can charge a costs that increases yearly, yet that would certainly make it extremely hard for most people to manage life insurance policy at sophisticated ages.

The Only Guide for Renters Insurance

Insurance coverage are made on the concept that although we can not stop unfortunate occasions taking place, we can secure ourselves monetarily against them. There are a substantial variety of various insurance plan readily available on the market, as well as all insurance companies attempt to persuade us of the benefits of their specific product. So much to ensure that it can be difficult to determine which insurance plans are truly necessary, as well as which ones we can reasonably live without.Scientists have discovered that if the primary wage income earner were to die their family would just be able to cover their household expenditures for simply a few months; one in four family members would have issues covering their outgoings right away. Many insurers suggest that you obtain cover for around 10 times your yearly income - insurance.

You must also factor in child care expenses, and also future university charges if suitable. There are 2 primary kinds of life insurance policy policy to pick from: entire life plans, as well as term life policies. You pay for whole life plans till you pass away, as well as you spend for term life plans for a collection period of time determined when you get the plan.

Health And Wellness Insurance, Health And Wellness insurance policy is another one of the four primary kinds of insurance that specialists advise. A recent research study disclosed that sixty two percent of personal bankruptcies in the United States in 2007 were as a straight result of health issue. An unexpected seventy 8 percent of these filers had health and wellness insurance when their ailment began.

The 8-Minute Rule for Cheap Car Insurance

Costs vary significantly according to your age, your present state of health, and your way of life. Also if it is not a lawful need to Web Site take out car insurance where you live it is highly suggested that you have some kind of plan in area as you will certainly still have to assume monetary obligation in the situation of an accident.Additionally, your automobile is frequently among your most important possessions, and if it is harmed in a mishap you may battle to pay for repair services, or for a replacement. You might additionally locate on your own accountable for injuries received by your guests, or the driver of another vehicle, and for damage caused to one more automobile as an outcome of your negligence.

General insurance policy covers residence, your travel, car, as well as wellness (non-life properties) from fire, floods, crashes, synthetic calamities, and also theft. Different types of basic insurance policy consist of motor insurance, medical insurance, travel insurance, and also house insurance coverage. A general insurance coverage spends for the losses that are sustained by the guaranteed throughout the duration of the policy.

Keep reading to understand even more regarding them: As the house is an useful ownership, it is necessary to secure your home with a correct. Home and also family insurance coverage protect your residence as well as the things in it. A residence insurance coverage essentially covers man-made and also his explanation natural conditions that may result in damage or loss.

Cheap Car Insurance Things To Know Before You Buy

It can be found in 2 types, third-party and comprehensive. When your vehicle is in charge of a crash, third-party insurance policy takes care of the damage caused to a third-party. You should take right into account one truth that it does not cover any of your vehicle's problems. It is also important to keep in i loved this mind that third-party motor insurance is compulsory according to the Motor Cars Act, 1988.

When it comes to wellness insurance, one can choose for a standalone health and wellness plan or a family members floater plan that uses coverage for all household participants. Life insurance policy offers protection for your life.

Life insurance policy is various from basic insurance on various parameters: is a short-term contract whereas life insurance policy is a long-lasting contract. In the situation of life insurance policy, the advantages as well as the sum guaranteed is paid on the maturity of the policy or in the event of the plan owner's fatality.

They are nonetheless not mandatory to have. The general insurance cover that is obligatory is third-party liability vehicle insurance. This is the minimum insurance coverage that a lorry need to have prior to they can layer on Indian roadways. Each as well as every sort of general insurance cover features a purpose, to use protection for a specific aspect.

Report this wiki page